Trust and Relationships First

We believe that brokerage begins and ends with exceptional customer service. While product expertise and industry experience are crucial, it’s the relationships and trust we build that truly matter. When you entrust us with your client’s business, we treat it as our own, because your business is more than just numbers—it’s families, dreams, and financial security on the line.

Breaking Away from the Conglomerates

The brokerage industry has seen countless rollups, diluting what makes this business great. We reject the trend of merging for profit at the cost of service. The landscape is littered with the ruins of these consolidations, and it’s time for a change.

Revitalizing an Old Industry

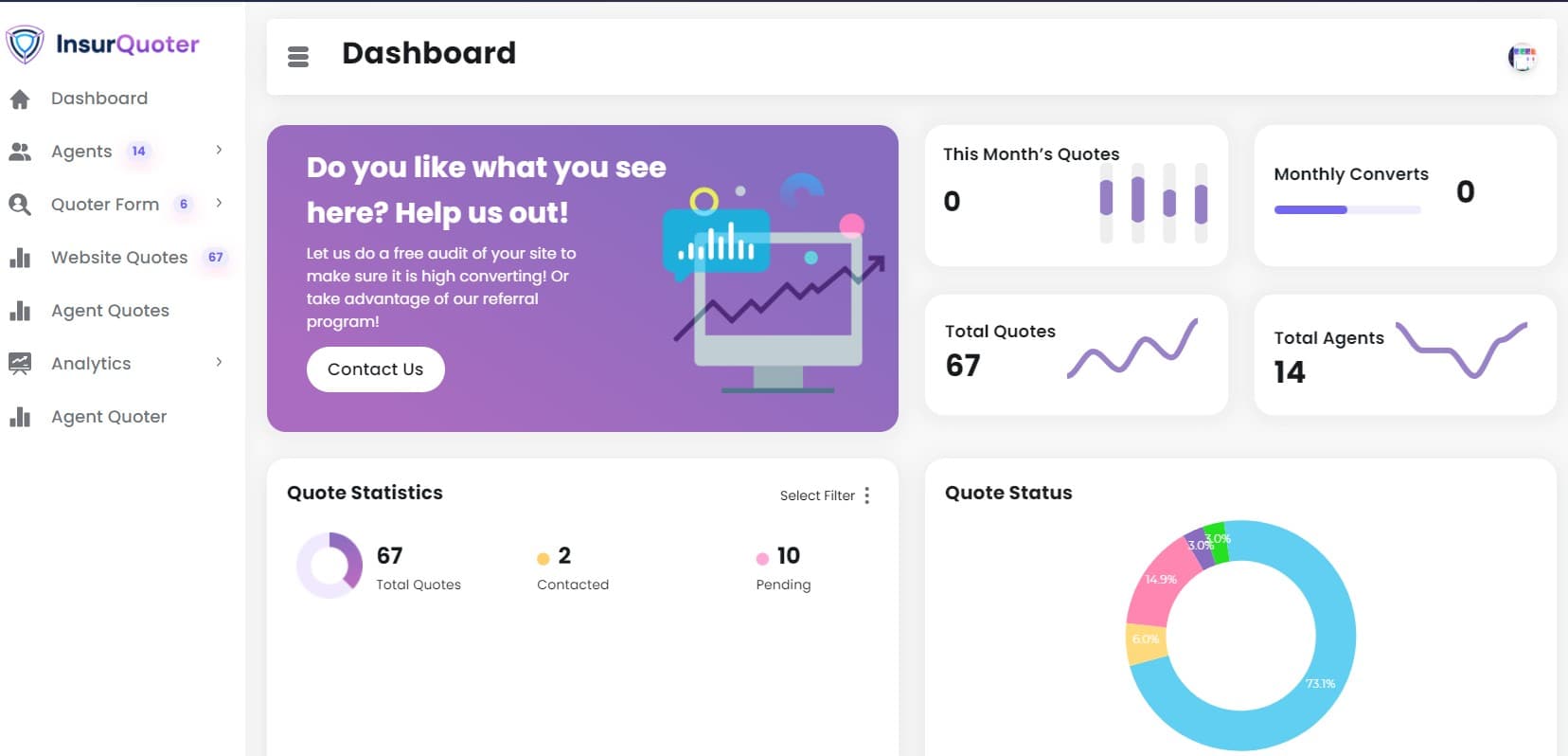

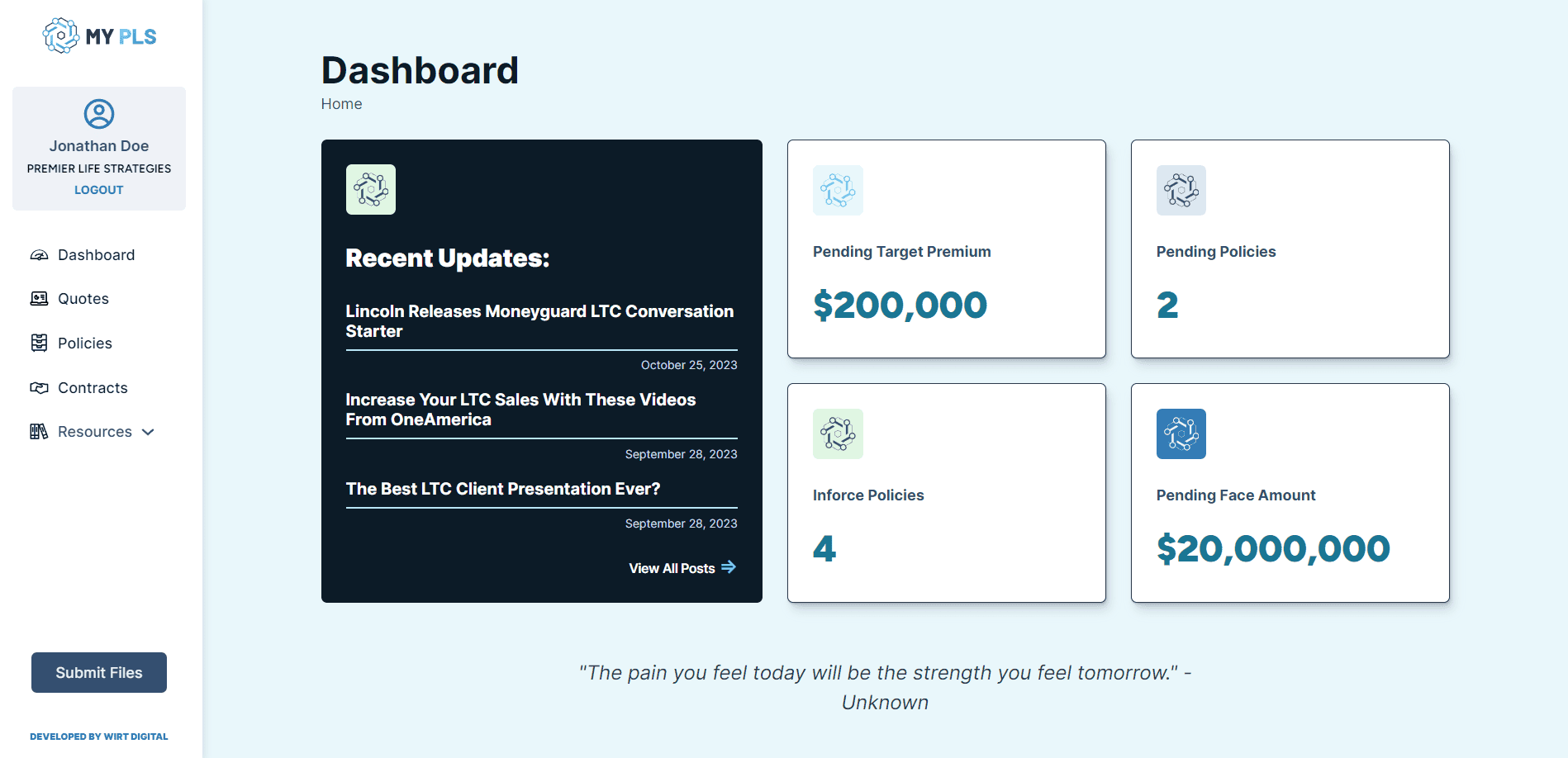

The life insurance space is at a crossroads. The old guard is being replaced by private equity-driven agendas that prioritize profit over people. We’re here to push back, utilizing technology not to replace service, but to enhance it.

A New Way Forward

Imagine an AI-powered underwriter, trained on our product knowledge, offering instant advice and ratings for your clients. Picture submitting a medical summary and receiving a thorough, well-structured report in seconds—all free of charge.

These are not just ideas; they are our commitment to reshaping the future of brokerage.

Join Us in the Fight

We’re on a mission to restore integrity and service to an industry that’s lost its way. Let’s preserve the heart of brokerage—together.